Introduction

- The pay audiovisual (AV) services market has been going through significant changes in the past decade: the quick roll-out of broadband internet-based IPTV services; the transition from analogue to digital cable service; the consolidation of pay-TV operators in the cable and satellite segments and obviously, the steady rise of subscription video-on-demand (SVOD) services.

- In this context, the aim of this report is to provide a big picture of the pay-services market in Europe and its evolutions since 2008. It provides key figures for the two main segments, linear pay-television and subscription video-on-demand and puts them into perspective. It identifies the main factors that are likely to affect their development, and identifies three different market configurations as regards the interactions between linear pay-TV and SVOD. And finally it presents the key players in the market.

- It is important to note that each national market has been and is still shaped by very specific conditions, often exogenous to the pay audiovisual services, including purchasing power, supply of free services, penetration and performance of broadband access and, obviously regulation. This report analyses the impact of some of these factors without claiming to identify a fully comprehensive set of “models” for the development of pay AV services.

Pay AV services get the lion’s share of the AV services market,...

-

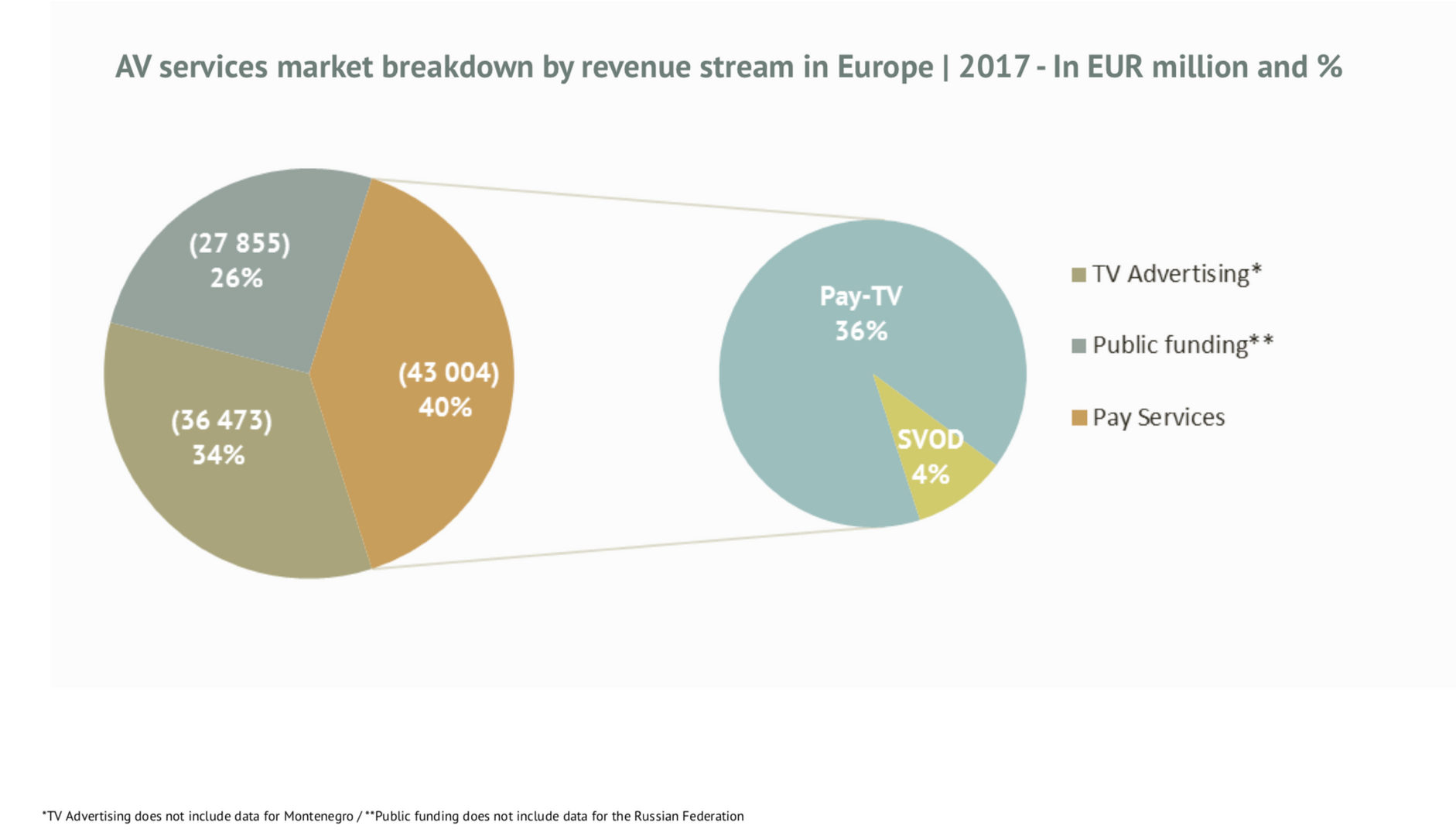

Pay AV services (pay-TV and SVOD) accounted for 40% of the AV services market in 2017

-

Among pay AV services, pay-TV represented 90% and SVOD the rest of 10%